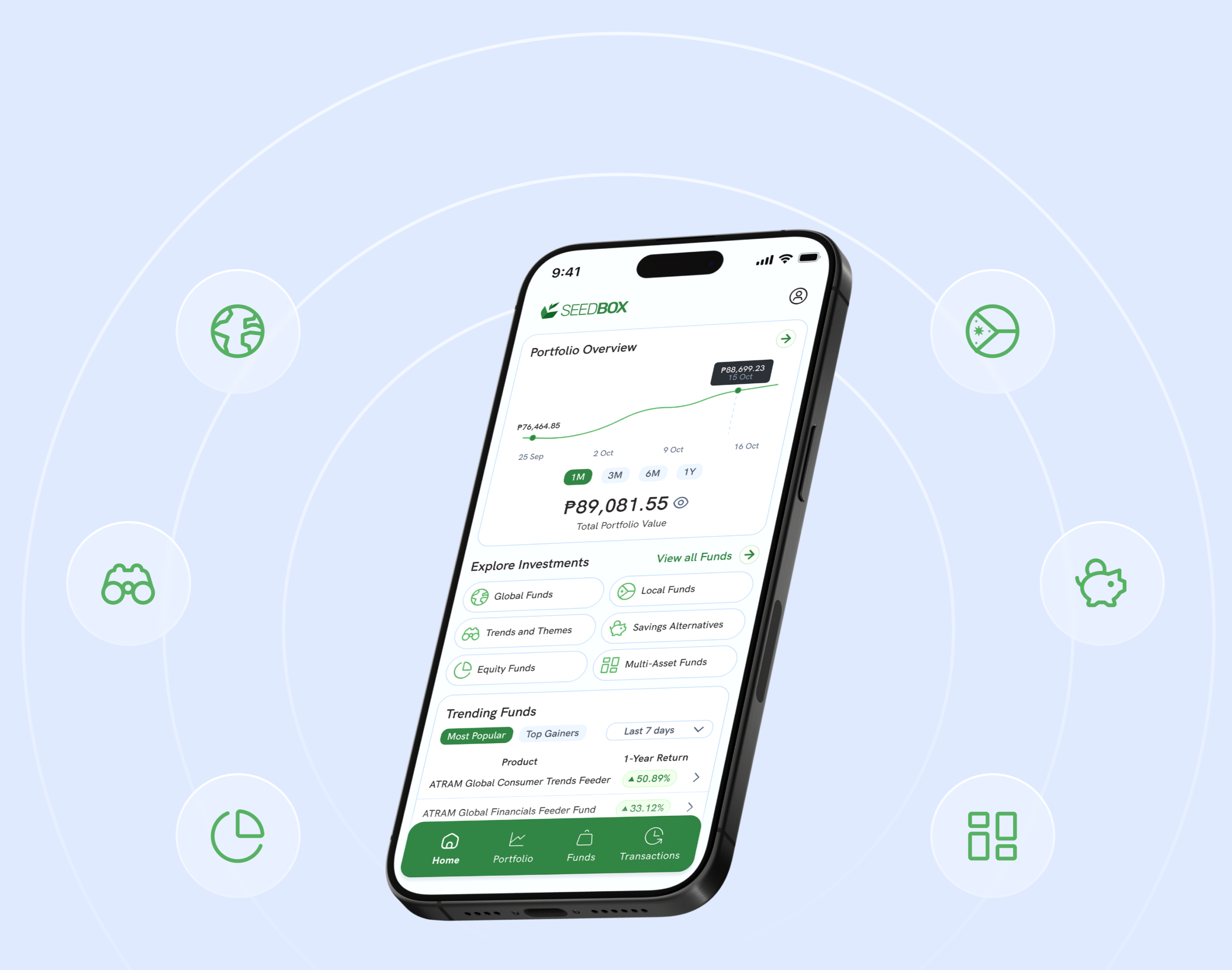

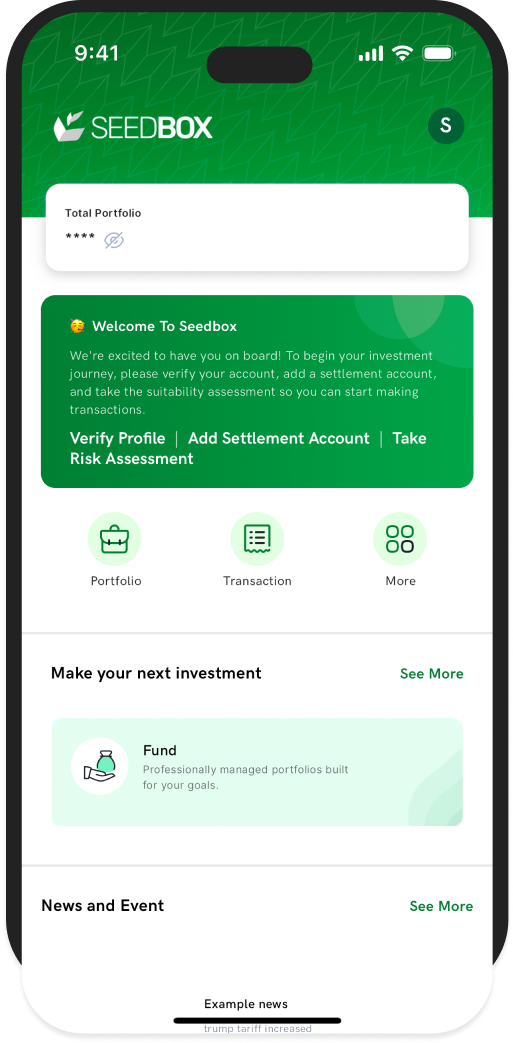

Invest today,

shape your tomorrow.

Find your next investment, from local funds and stocks to global opportunities.

Find your next investment, from local funds and stocks to global opportunities.

PARTNERS

PLATFORM PARTNERS

TRUSTED SINCE

2016

Achieve what matters most.

Invest in industries you care about, from tech to healthcare and beyond, while building the future you envision.

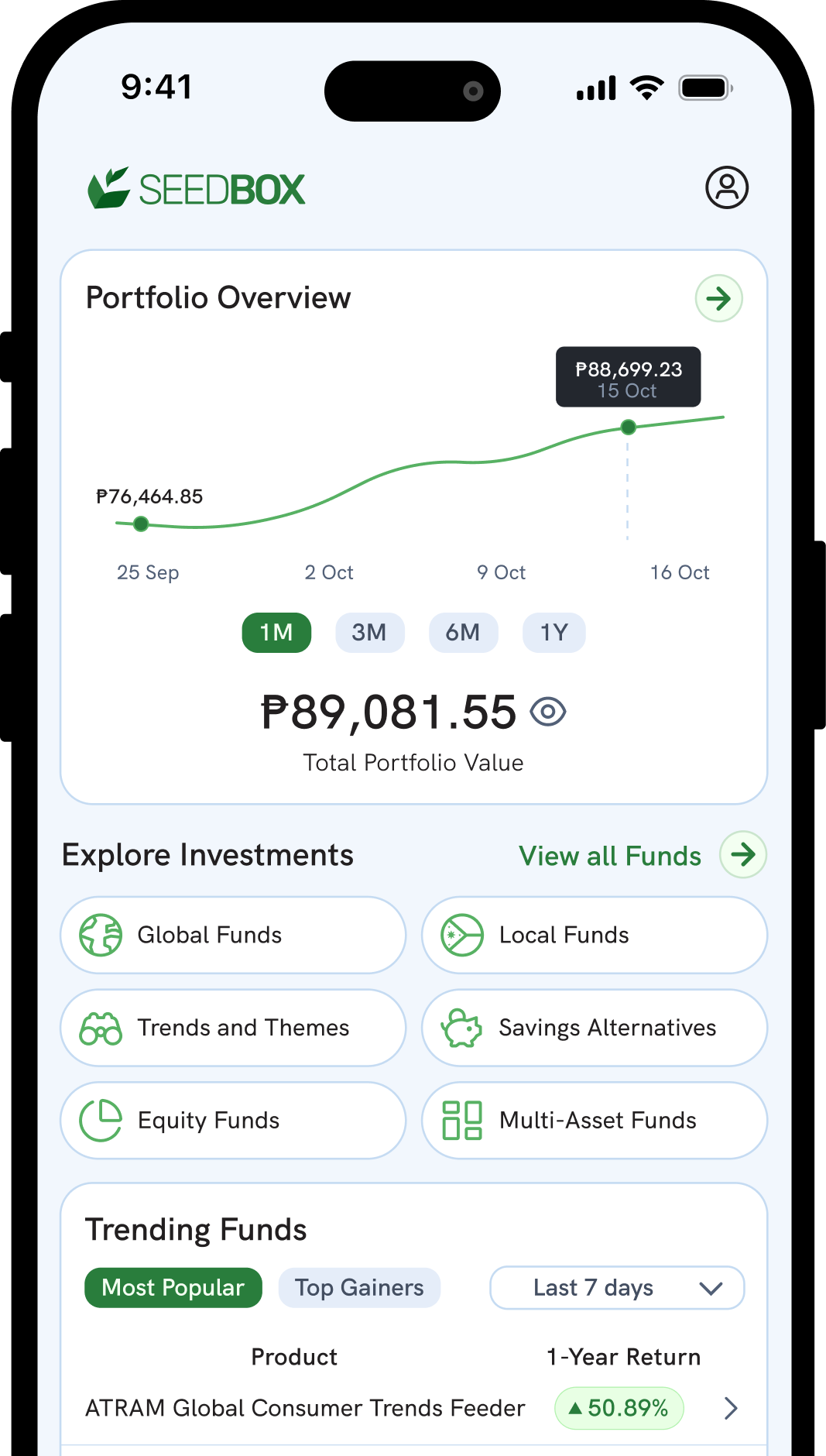

What we offer

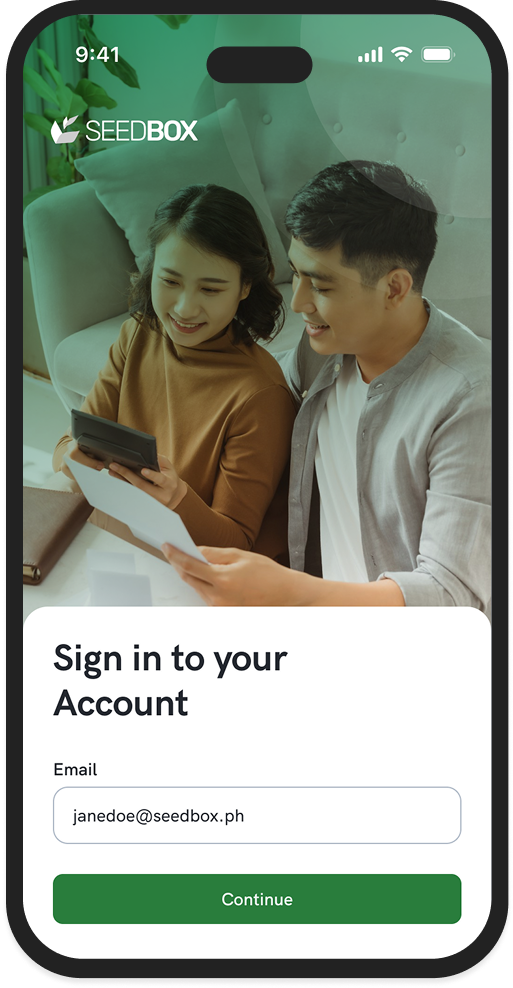

No need, we’ve migrated your account information to the new app. All you need to do is enter your email and follow the instructions to update your password.

Our customer support team is ready to help you via support@seedbox.ph (mailto:support@seedbox.ph).

Try the app now.

We’re just getting started. More features and tools are coming your way. Be the first to get the latest updates and product launches.

Shape your tomorrow, today.

Set-up your account now. It’s online and free.

01

Download the Seedbox app and sign up.

02

Complete your profile details and get fully verified.

03

Find a product that works for you so you can build the habit of investing regularly.